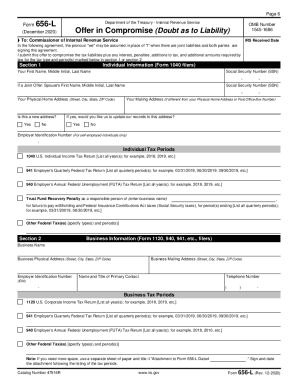

IRS 656-L 2024-2026 free printable template

Instructions and Help about IRS 656-L

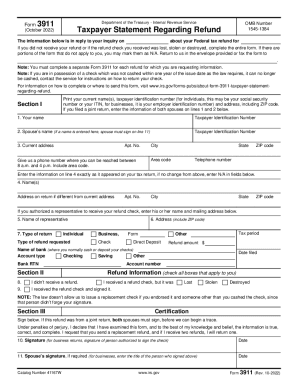

How to edit IRS 656-L

How to fill out IRS 656-L

Latest updates to IRS 656-L

All You Need to Know About IRS 656-L

What is IRS 656-L?

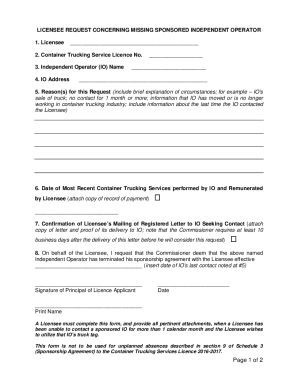

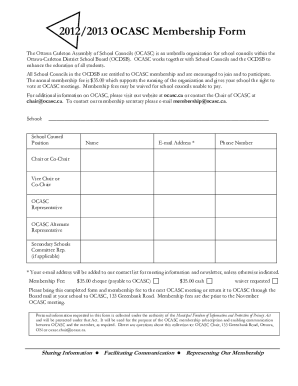

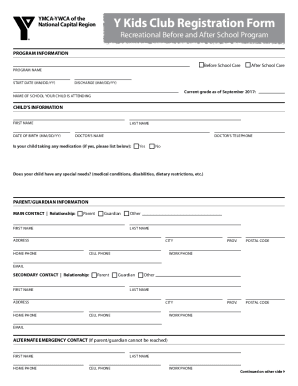

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

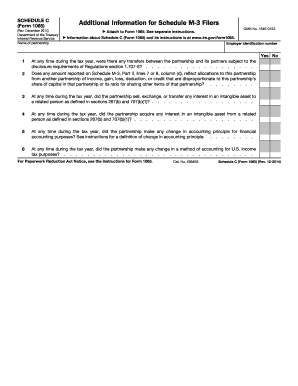

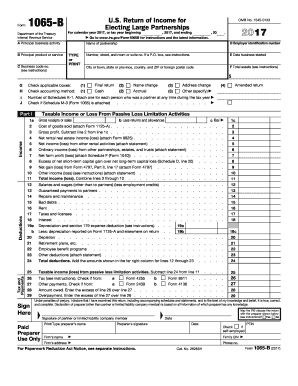

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 656-L

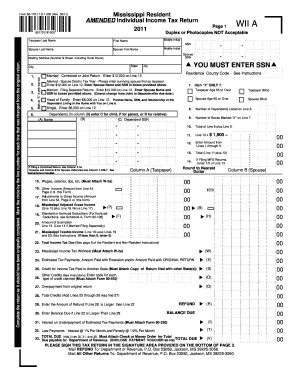

What should I do if I realize I've made a mistake after filing IRS 656-L?

If you notice an error after submitting your IRS 656-L, you can correct it by filing an amended version of the form. Ensure that you clearly indicate the changes made and reference the original submission. It’s advisable to submit the amendment as soon as the error is identified to prevent complications with your tax records.

How can I check the status of my filed IRS 656-L?

To verify the status of your IRS 656-L submission, you can use the IRS online tools or contact their customer service. Be prepared to provide your identifying information and the details of your submission. Common e-file rejection codes may guide you on troubleshooting any issues encountered during processing.

What should I know about e-signatures on the IRS 656-L?

E-signatures are permitted when filing IRS 656-L electronically, as long as the signature complies with IRS standards for authenticity and security. Retain copies of your e-filed documents for your records, as this helps maintain data security and supports claims in case of audits or inquiries.

What common errors should I avoid when filing IRS 656-L?

Common errors when filing your IRS 656-L include incorrect personal information and miscalculating your tax obligations. To avoid these mistakes, double-check all entries and ensure compliance with IRS guidelines. Utilizing IRS resources can also help in confirming that your submission adheres to the required standards.

What should I do if I receive a notice from the IRS regarding my IRS 656-L?

If you receive a notice from the IRS concerning your IRS 656-L, it's crucial to read it carefully and understand the IRS's concerns. Gather all pertinent documentation related to your submission and respond promptly if required. This will ensure that you address any issues effectively and maintain compliance with IRS regulations.